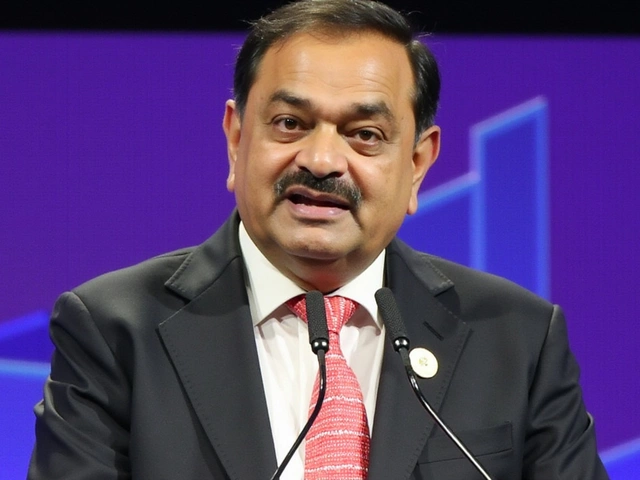

The Adani Group, one of India's largest conglomerates, finds itself in deep waters following a significant drop in stock prices on November 21, 2024. Shares took a nosedive after the chairman, Gautam Adani, and other key players were indicted by U.S. federal prosecutors over a $250 million bribery scheme concerning Indian solar energy projects. This setback comes hot on the heels of another major controversy, leaving investors and stakeholders watching the fallout closely.

Adani Stocks Take a Hit

Several stocks within the Adani portfolio were significantly affected by the latest developments. Adani Energy Solutions saw its value tumble by 20%, closing the day at Rs 697.25. Adani Green Energy was not far behind, with its shares sinking 17% to Rs 1,172.5. Meanwhile, Adani Enterprises recorded a 10% fall, ending at Rs 2,539.35. These fluctuations are a stark indicator of the market's reaction to the unfolding scandal.

The indictment, filed in the Eastern District of New York, paints a troubling picture. Gautam Adani, along with his nephew, Sagar Adani, and former CEO of Adani Green, Vneet S Jaain, are accused of orchestrating a bribery racket. The alleged scheme aimed to secure valuable solar energy contracts. The indictment further accuses them of misleading investors and destroying evidence to avoid scrutiny. As the details of the charges emerge, the situation only grows more tense for the involved parties.

Legal and Financial Repercussions

The incident has sparked a dual-pronged legal response. While the U.S. Securities and Exchange Commission (SEC) has initiated civil procedures, the Department of Justice (DOJ) seeks to pursue criminal action under the Foreign Corrupt Practices Act. This coordinated response underscores the seriousness with which these allegations are being treated on the international stage.

As if the stock market ramifications weren't enough, there are consequential financial reverberations too. Bonds issued by Adani Green Energy and Adani Electricity Mumbai have hit record lows, reflecting investor panic and diminished confidence. Furthermore, the group's plans to issue a $600 million bond have been shelved amid the turmoil. It's a financial one-two punch adding strain to an already taut situation.

This isn't the first time the Adani name has been embroiled in controversy. In 2023, a report by Hindenburg Research chipped away over $150 billion in market value, spotlighting vulnerabilities within the group's operations. Now, with this fresh scandal, Adani finds itself at a precarious juncture where both reputation and financial integrity are seriously at risk.