A Massive Blow to Adani Group's Market Valuation

This week, the stock markets obscured no secrets as Adani Group companies endured a significant financial repercussion, marking their worst trading outcome since the unsettling Hindenburg crisis earlier in 2023. A monumental Rs 2 lakh crore in market value vanished abruptly from its various sectoral wings, also ringing alarm bells for large sections of investors. The deep dive that these stocks took was triggered by grave allegations of bribery brought by the US Department of Justice and the US Securities and Exchange Commission against Gautam Adani, the chairman of the group, and several associated entities. This unsavory news sent shockwaves across global financial markets, casting doubts on the governance and transparency standards within one of India's largest conglomerates.

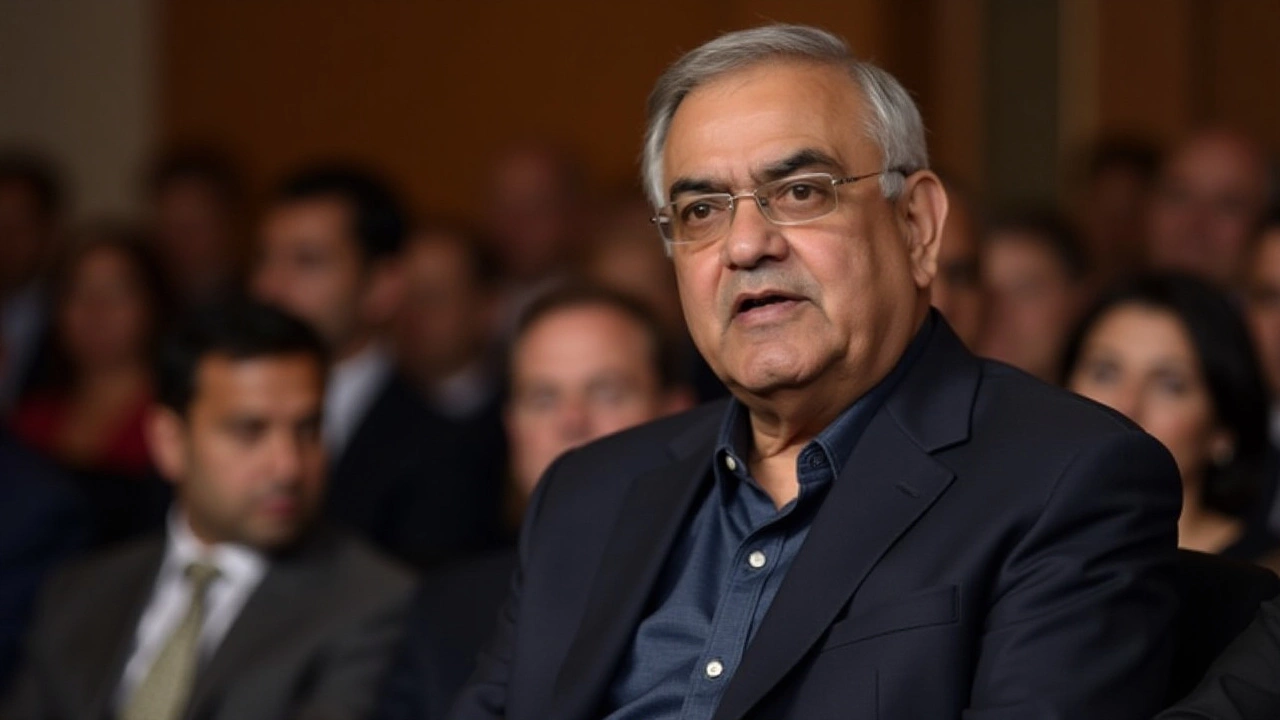

The Ripple Effect on Gautam Adani's Wealth and Rankings

At the helm of this tumultuous situation is none other than Gautam Adani, whose colossal empire has been the epicenter of both adulation and critique. Forbes has reported that his net worth saw an excruciating decline by $12.1 billion, echoing the systemic impact these allegations have had on his personal and professional standing. From a previously towering stature among the world's top billionaires, Adani has slipped to the 25th position. This notable fall places him well behind Mukesh Ambani, the powerhouse behind Reliance Industries, who leads as India's wealthiest with an estimated fortune of $96.5 billion.

Adani Group Companies Take a Major Hit

The ripple effects were broadly felt across various Adani Group companies. Adani Enterprises, often seen as the flagship venture and pride of the group, witnessed an unprecedented 23% fall in its stock price, translating into a market cap erosion of approximately Rs 73,600 crore. As the hub of the allegations centered by the US DOJ's bribery charges, Adani Green Energy also found itself in dire straits, with shares plummeting by 19% and approximately Rs 42,000 crore slashed from its market value. The developments did not spare other companies; Adani Energy Solutions and Adani Ports recorded downturns of 20% and 13.5%, respectively. Even Adani Wilmar and Adani Total Gas were caught in the crossfire, declining roughly around 10% each, further exacerbating investor concerns.

Implications for the Broader Market

This economic upheaval did not remain an isolated occurrence for the Adani Group; the ripple effects spread far and wide, encapsulating broader Indian stock indices in their disruptive wake. The Sensex, a bellwether for market sentiments, opened lower, briefly teetering below the crucial 77,000 mark to reach an intraday low of 76,803 points before managing a weak recovery to close at 77,156 points, down by a not insignificant 423 points. Similarly, the Nifty followed suit, ending the day at 23,350 points, down by 169 points.

The Dynamics of Investor Sentiment

Foreign portfolio investors led a chorus of sell activities, staging a net outflow of Rs 5,321 crore. Conversely, domestic players picked up the buying slack, albeit tentatively, with net purchases around Rs 4,200 crore. Over the evolving financial landscape of the month, foreign portfolio investors have offloaded stocks exceeding Rs 33,000 crore within the secondary market realm. This persistently cautious environment continues to shape and reshape economy-linked metrics, emblematic of the delicate balance teetered amidst domestic and foreign interests.

Banks Feel the Stress

This market turbulence also ushered in a chain reaction affecting India's banking stocks. Many financial institutions that had previously held optimistic positions in Adani's enterprises now find themselves in a scrambling retreat. The likes of Bank of Baroda saw its stock tail off by 3.6%, while Canara Bank's shares fell by 3.3%. Even the imposing State Bank of India wasn't immune, witnessing a 2.6% decline. This reflects growing apprehension related to potential exposure and underlying liabilities tied to the dealings and broader financial ecosystem of the Adani Group.

The Way Forward

Despite the current downswing in fortunes, some in the financial sector continue to hold a belief in a potential turnaround or stabilization. Notably, Goldman Sachs has shown a continued recommendation for Adani Ports & SEZ with a 'buy' rating, suggesting an expectation for potential recovery or growth in its intrinsic value once the current storms pass. However, the cloud of litigation and investigation looms large, casting a shadow over perceptions and decision-making processes that could alter the financial landscape further.

Conclusion

While the road to rehabilitating investor trust and ensuring clear governance remains long, the recent setbacks present pivotal moments for introspection and strategic realignment for Adani Group companies. The narrative unravels layers of complexity interwoven amid evolving accusations and regulatory frameworks. It will undoubtedly be intriguing to monitor the ensuing legalities, business recalibrations, and investor maneuvers as this high-stakes financial saga continues to unfold across both Indian and global landscapes.