Allegations Against Gautam Adani and Associates

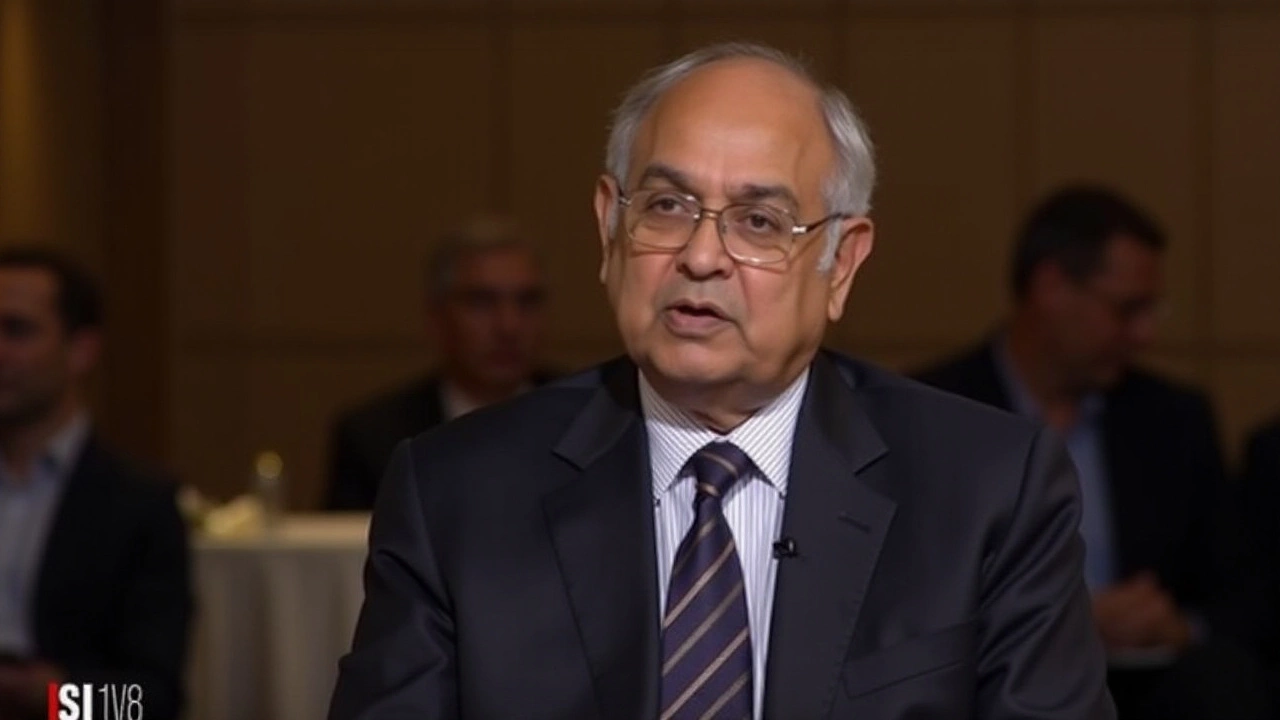

The U.S. Securities and Exchange Commission (SEC) along with the Department of Justice (DOJ) have made headlines with their recent charges against Gautam Adani, the renowned Indian billionaire and chairman of the powerhouse conglomerate, Adani Group. This legal action has caught the attention of the global business community, due to the scale and gravity of the alleged crimes. Adani, alongside seven others, is charged with engaging in a multibillion-dollar bribery and fraud scheme, sending ripples across industries and raising concerns about corporate integrity and governance in India. The charges unveiled on November 20, 2024, encompass serious offenses such as securities fraud, conspiracy to commit securities fraud, and wire fraud conspiracy. Such charges typically carry significant legal ramifications and hint at intricate and potentially damaging operations within big businesses. Adani’s associates facing these charges include his nephew, Sagar Adani, and Vneet Jaain, the erstwhile CEO of Adani Green Energy, underscoring the involvement of high-ranking officials in dubious financial practices.

Details of the Fraud Scheme

According to the indictment, the defendants allegedly orchestrated payments approximately amounting to $265 million aimed at bribing Indian government officials. The primary goal of these payments, reportedly disguised under the innocuous term 'development fees,' was to secure lucrative contracts to construct India's largest solar power project. This project promised to generate an estimated profit of $2 billion over a span of two decades. Such fiscal promises provide ample motivation for participants to engage in illicit activities to secure necessary governmental contracts and permissions, reflecting the darker side of competitive business dynamics. Moreover, the accused parties are also said to have amassed over $3 billion in loans and bonds under false pretenses, misleading both lenders and investors by concealing their corrupt practices. Such substantial amounts in financial gains and transactions underscore the sophistication and potential reach of the fraudulent operations detailed within the charges.

The Legal Implications and Accused Individuals

The filing of these charges occurred in a federal court situated in Brooklyn, New York, a strategic location for prosecuting international and significant financial crimes. Arrest warrants for key figures, including Gautam Adani and his nephew, Sagar Adani, reveal the seriousness of the allegations and the severity with which the law intends to pursue the accused individuals. Besides the Adanis, the accused include Ranjit Gupta and Rupesh Agarwal, previous executives from Azure Power Global, an acknowledged player in India's solar energy sector. Additionally, Cyril Cabanes, also charges with these crimes, served as an Azure director and previously was involved with the Canadian institutional investor Caisse de Depot et Placement du Quebec. It's worth noting that all the defendants are Indian except for Cabanes, who holds dual citizenship in France and Australia, residing in Singapore. This international component adds a layer of complexity to the case, given the varied jurisdictions and legal systems involved.

Impact on the Adani Group and Indian Corporate Governance

The Adani Group, a critical player not just in India’s infrastructure but in global markets, stands potentially imperiled by these charges. The allegations, if proven, could lead to notable repercussions on its operations, valuation, and partnerships, especially concerning international endeavors and ambitions. Furthermore, these developments fuel broader inquiries and criticisms into the mechanisms of corporate governance within India, punctuating ongoing concerns around crony capitalism and regulatory oversight. Today’s investors and stakeholders demand transparency, accountability, and ethical conduct from the companies they support, making the outcomes of such high-profile cases pivotal.

Adani Group's Response and Market Reactions

In light of the indictment, the Adani Group has vehemently denied any wrongdoing. They have termed the accusations as 'baseless,' indicating their intention to vigorously defend against the charges through legal avenues. The group's commitment to countering these allegations and the subsequent scrutiny on their practices highlights the intersections of law, ethics, and business operations. Meanwhile, markets and analysts keep a keen eye on the developments, knowing that the outcomes could significantly influence investor confidence and market dynamics related to the Adani Group and potentially similar conglomerates. Observers speculate on the broader implications for foreign investment sentiments towards India, scrutinizing governance issues and their impacts on economic policies.

Global Business and Investors Observations

As the situation unfolds, it showcases the increasingly intertwined nature of local business activities and global legal frameworks. In an age of robust international finance systems, businesses often cross national boundaries, implicating numerous jurisdictions and regulatory bodies. This case serves as a telling example of how companies must navigate these complexities while adhering strictly to legal and ethical norms. For Indian companies with ambitions on the global stage, these charges underline the necessity of robust compliance and governance frameworks. Global investors and businesses now look to see how Indian corporations, regulators, and the government respond to such significant allegations.

Potential Reforms and Future Outlook

Looking ahead, this situation could catalyze important discussions on necessary reforms within India’s corporate sector. It might spark rigorous debates on existing regulatory frameworks, pushing for stricter enforcement and transparency initiatives. Such reforms could potentially enhance the corporate world’s reputation, safeguarding both domestic and foreign investments in the long term. Moreover, the ongoing legal proceedings will certainly be pivotal in setting precedents for future cases, defining how large corporations balance ambitious business pursuits with ethical constraints. As information continues to emerge in this landmark case, business leaders, policy makers, and regulators across the globe will undoubtedly be watching closely.